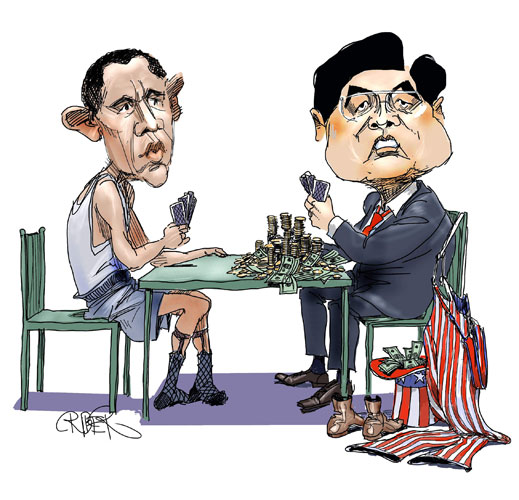

{ok}my question, what I suppose.USA Is broke. We need at least 1[one

trillion $ more than taxes bring in to the treasury{US institution}

1]step one , congress passes increase in US Debt Ceiling [2}no one wants to lend money to USA at 0% to %3 for 10 years.China has

excess dollars from trade with us, but does not want to lend to US> 2] so I think, US treasury calls JP MORGAN ,to raise 1 trillion

US $$$$[they take a small underwriting fee}{this is million of US

Dollars.3} JP Morgan call the Federal Reserve{a private bank>>>

who in 1966, took over issue of US currency>>>they replaced

silver certificates{issued by the US treasury,redeemable from

Fort Knox bullion depository>>in 1966 for one dollar,of fine silver bullion}NOW [3] the good part!!!!!The Federal RESERVE,nothing federal, just a name, Like Harry,TIM or Johns reserve bank, goes to the basement, pulls $100 bills puts in trucks>>>>and to save time++++by right the armoured cars should go to JP Morgan>>>and JP Morgan , should hire new trucks to take the money to the US Treasury in DC, to put into vaults. [4} the

underwriter takes delivery , of $1,000,000,000,000 [ trillion}

of USA Treasury securities, and delivers them to the {federal reserve bank} -*************WHA LA "RABBIT OUT OF EMPTY HAT" OR

$1 TRILLION OUT OF EMPTY HAT{ THE FEDERAL RESERVE, CONTRACT OUT

TO HAVE AS MUCH CURRENCY, AS THEY THINK THE COUNTRY WILL NEED{the

money in your pocket says"this note is legaltender for all debts,public and private, by signature Treasurer of the United

States{why does the US Treasurer, sigh a note issued by a "private bank>>the "federal reserve bank" see $100 note HC38112363A {georgeacquire@juno.com} please correct me, somebody!!!!

2 Answers

| 13 years ago. Rating: 0 | |

georgeacquire

georgeacquire

Chiangmai

Chiangmai

schiz

schiz

is in error { george acquire}